THE DEBT-FREE PLAYBOOK + TOOLKIT

"The Debt-Free Playbook + Toolkit: A Step-by-Step Guide to Pay Off Debt and Take Back Control of Your Life" isn't just another theoretical guide. It's a comprehensive playbook that represents the culmination of all the strategies and methods used to help clients get out of debt since 2021. This proven system has helped Filipinos pay over ₱4.1 million in debt.

The powerful C.L.E.A.R. Method that transforms overwhelming debt into manageable steps

Practical debt repayment strategies customized to your unique situation

How to maintain motivation throughout your journey to debt freedom

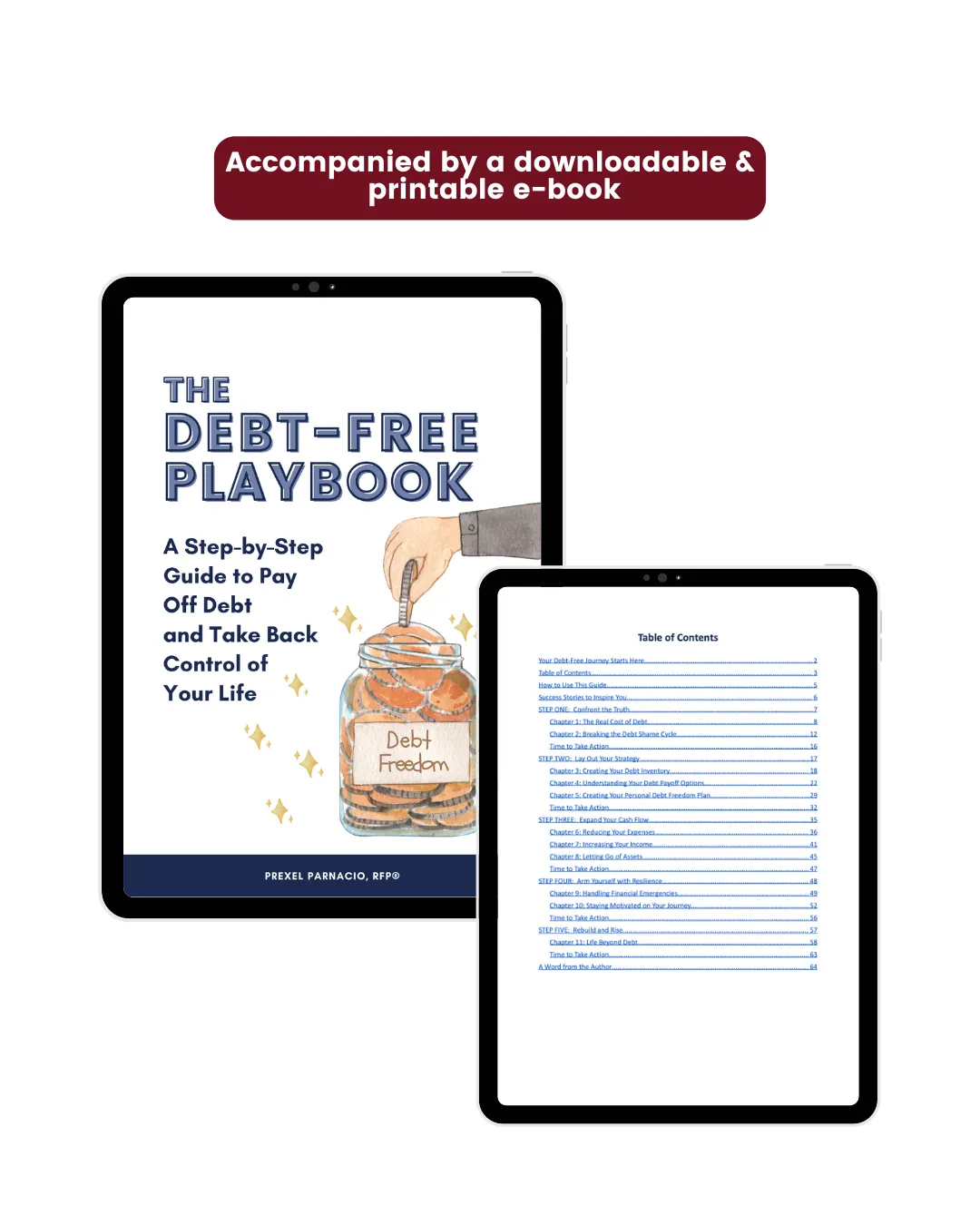

Own course portal plus a printable e-book

Free lifetime access to all updates & additions to the Toolkit

Instant access after purchase!

CREATED BY A PERSONAL FINANCE EXPERT WITH OVER 8 YEARS EXPERIENCE IN THE FINANCIAL INDUSTRY

Prexel Parnacio is a Registered Financial Planner® and Financial Coach with over 8 years of professional experience in the financial industry.

She founded Millionaire in Progress in 2017 and has since helped hundreds of Filipino professionals improve their relationship with money through coaching, consultations, and financial education.

Her approach combines data-driven strategy, behavioral finance, and values-based decision-making. As of October 2025, her clients have collectively paid off more than ₱4.1 million in debt.

Inside the playbook

Preview the material before you dive in

The C.L.E.A.R. Method dicussed in 11 Chapters

Step 1 – Confront the Truth by understanding debt and shifting your mindset

Step 2 – Layout Your Strategy by creating a personalized debt payoff plan

Step 3 – Expand Your Cashflow using practical ways to speed up your progress

Step 4 – Arm Yourself with Resilience by staying disciplined & prepared through challenges

Step 5 – Rebuild & Rise by designing your life after debt and setting new financial goals

Each step comes with reflection prompts, fill-in-the-blank exercises, and clear next actions so you’re not just reading but making real decisions.

Toolkit preview

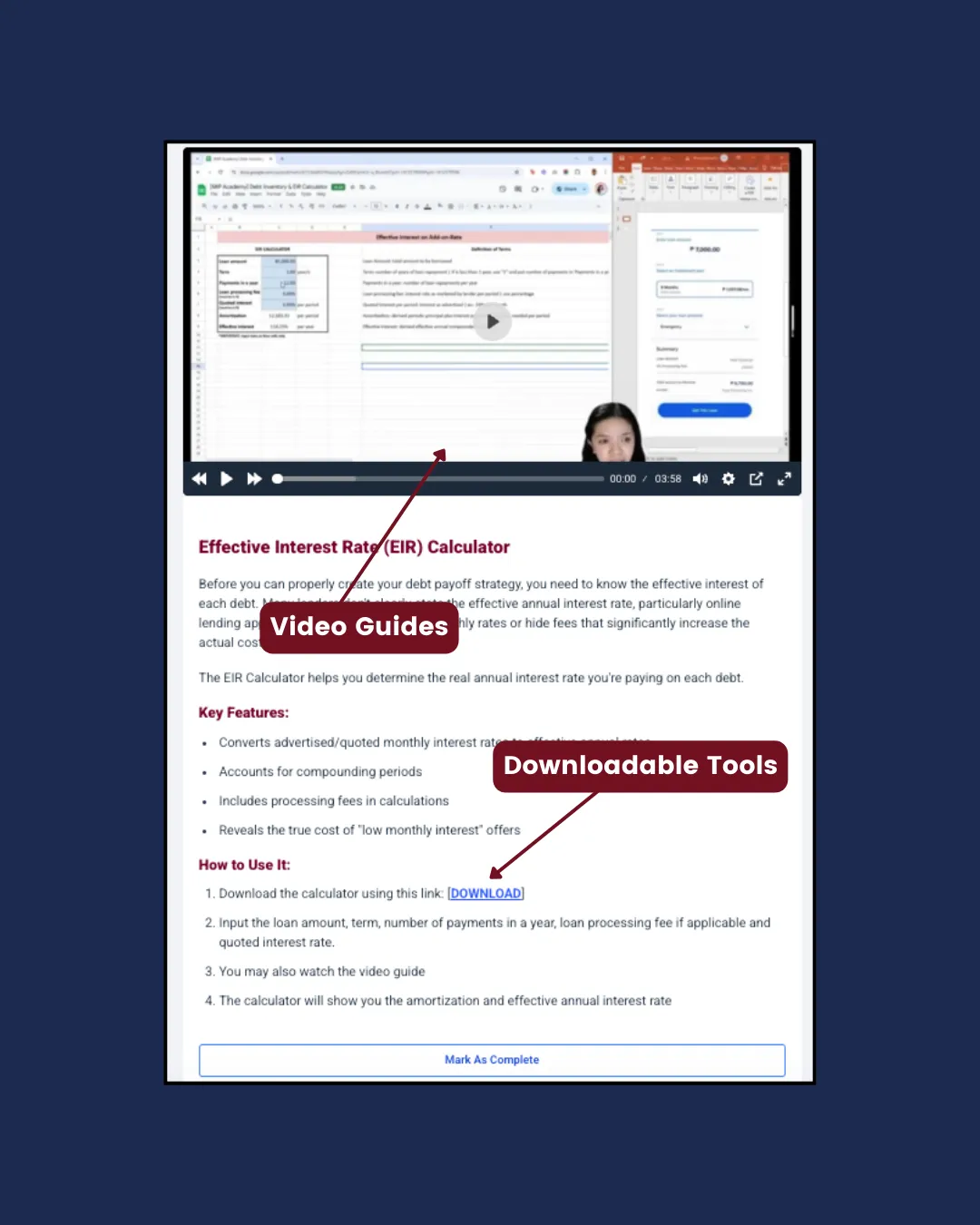

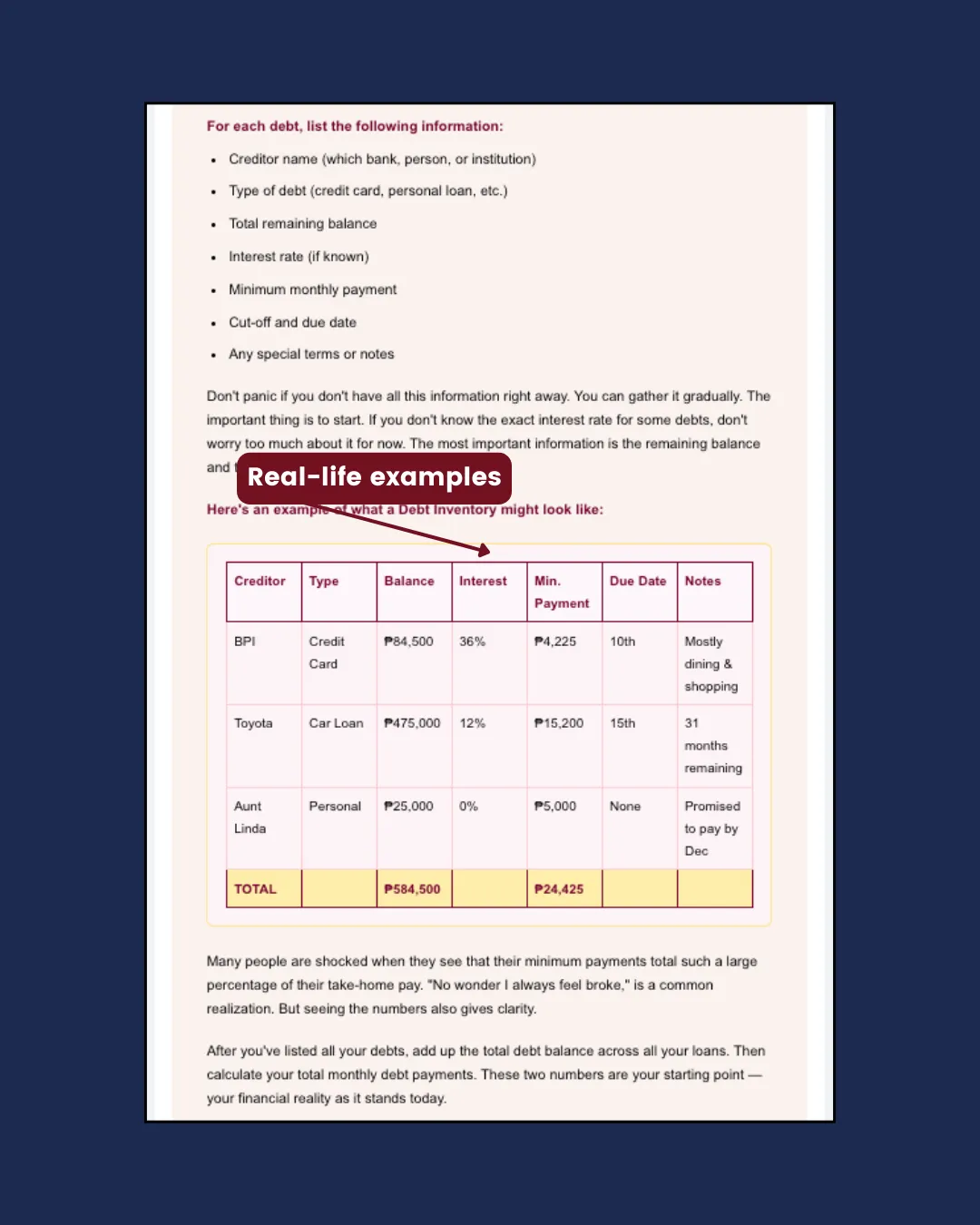

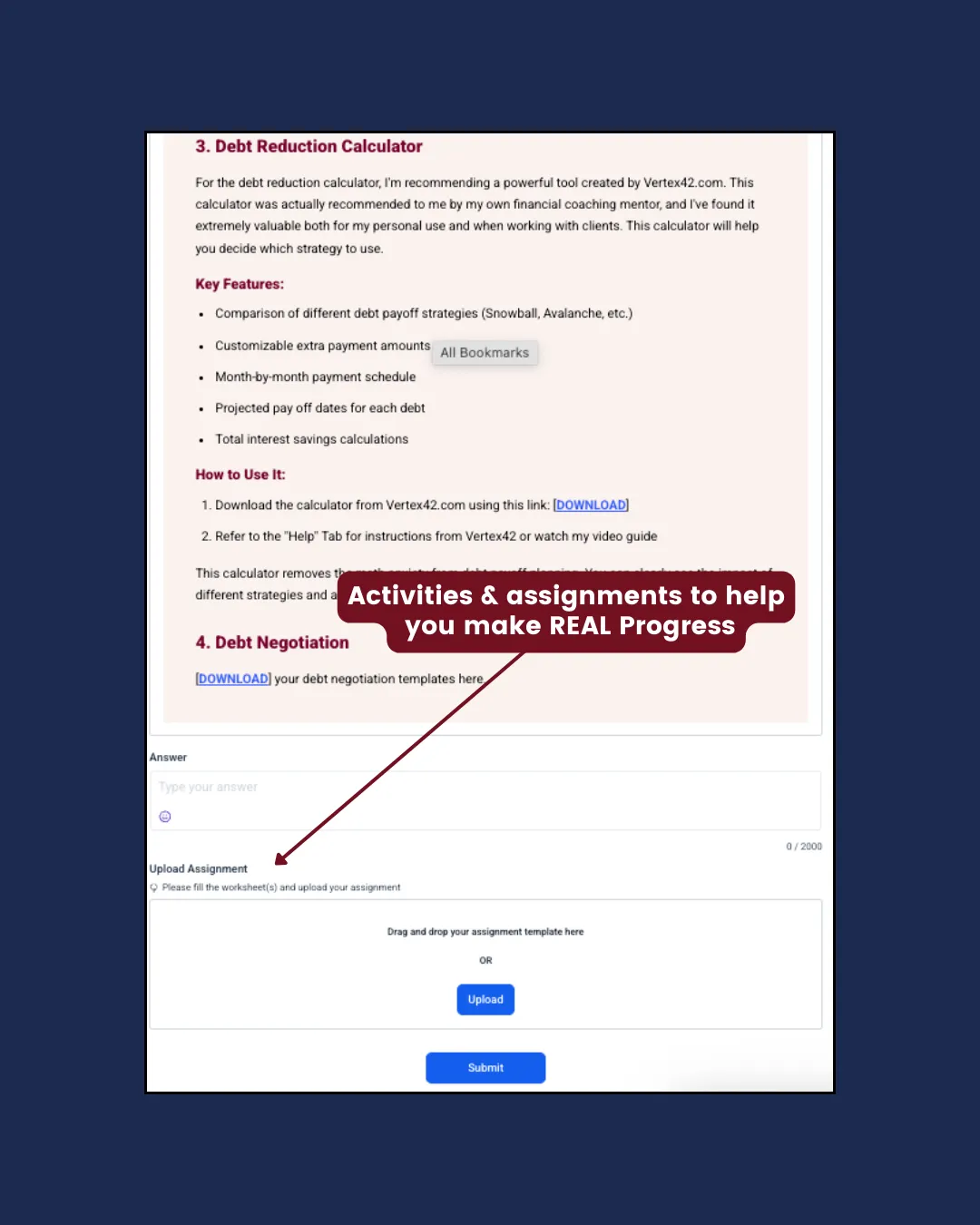

Debt Inventory & Tracker (Worksheet + Video Guide)

Automated Debt Calculator (Worksheet + Video Guide)

Effective Interest Rate Calculator (with Video Guide)

Debt Negotiation Templates (Ready-to-use Script)

Progress Visualization Tools (Printable)

WHAT YOU GET

A Complete system, not just more generic advice

The Debt-Free Playbook + Toolkit combines self-paced learning with done-for-you tools and light-touch support so you’re never stuck wondering, “Okay, what do I do next?”

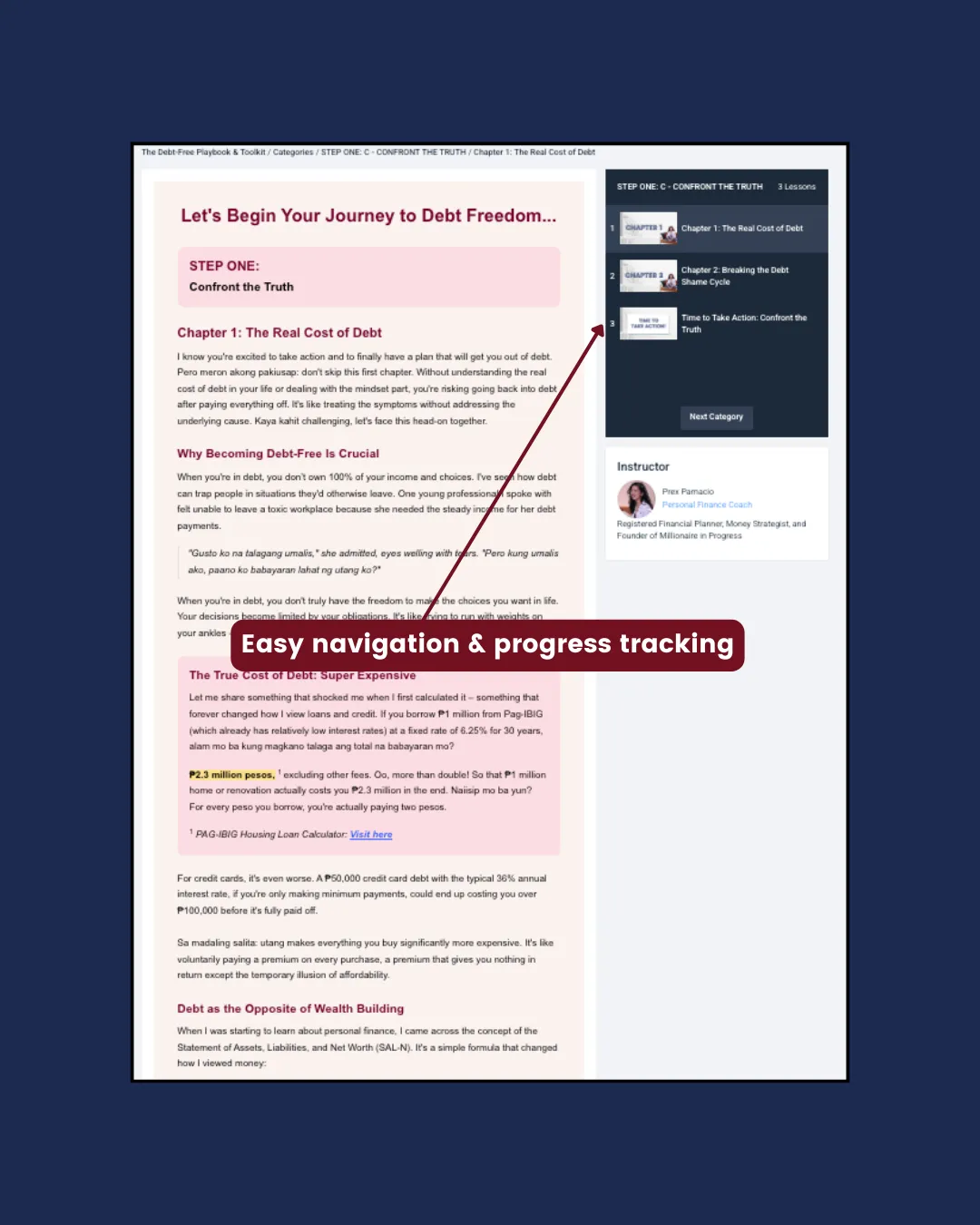

Self-paced online portal

A structured learning experience with short, clear sections. You can move quickly on familiar topics and slow down where you need more reflection.

Format: Web + downloadable PDF, accessible on phone, tablet, or laptop.

Plug-and-play toolkit

Ready-made spreadsheets, trackers, and scripts so you don’t have to build everything from scratch or second-guess your formulas.

Includes: debt trackers, payoff simulators, payment calendar, and reference templates.

1-1 Guidance Opportunity

Short videos for complex parts of the process, plus optional upgrade if you want 1:1 review or feedback on your plan.

Best for: people who like to work independently but want a clear, proven structure to follow.

get it now

No more guessing & stress, have a debt payoff plan in 14 days

Use the playbook and toolkit as often as you need—whether you’re paying off your first card or resetting after a big life change.

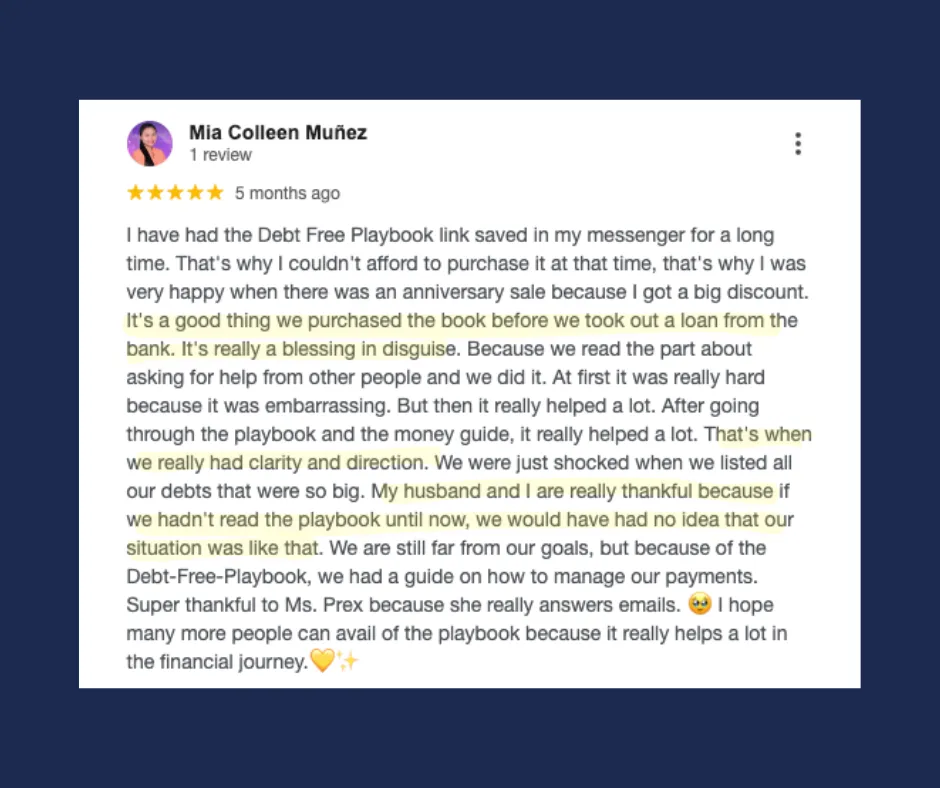

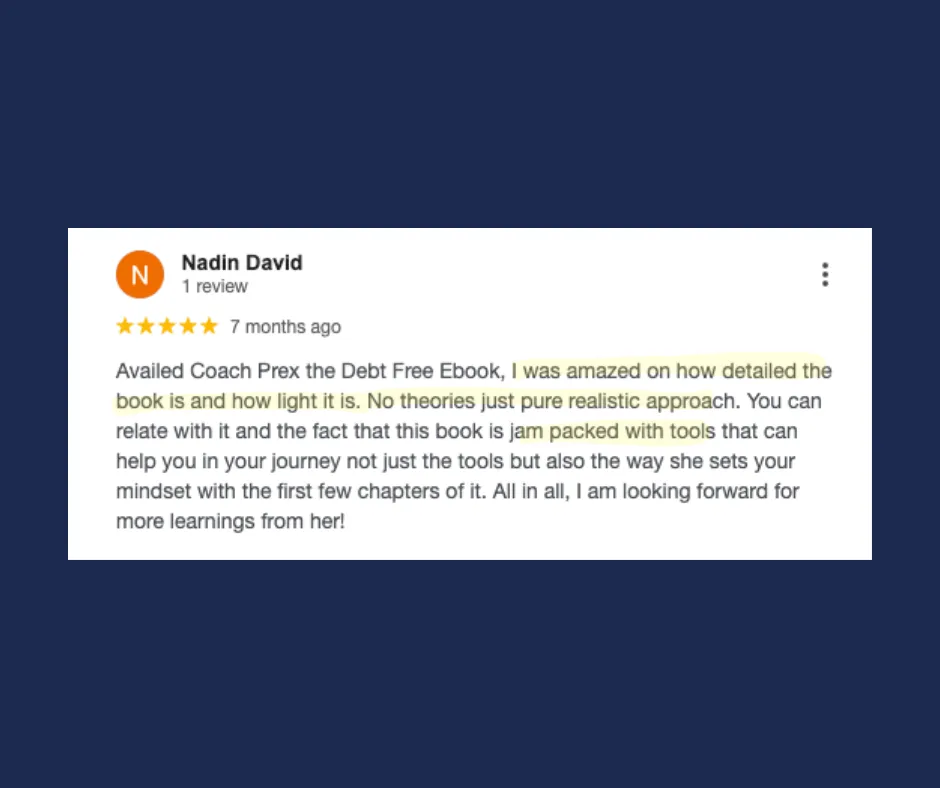

REAL STORIES, REAL PROGRESS

Customer Reviews & Testimonials

Frequently Asked Questions

Is this only for people in the Philippines?

The examples, numbers, and scenarios are designed around Filipino realities—local salaries, bonuses, family responsibilities, and common loan products. If you’re a Filipino based abroad, you’ll still find the frameworks helpful, but the references (13th month, SSS, Pag-IBIG, etc.) are very PH-specific.

How much time do I need to finish the playbook + toolkit?

Most students complete the core material in 2–3 weeks by spending about 30-45 minutes per session, 3 to 4 times a week. You can absolutely go faster or slower. It’s designed so you can pause and resume without losing your place.

I’m already drowning in utang. What if this doesn’t work for me?

This is exactly why the playbook exists. You’ll start by getting a clear, kind picture of your current situation, then choose a payoff strategy that matches your reality, not someone else’s ideal. You might be able to pay-off your debts in a few weeks, but yo'll be guaranteed to have a CLEAR plan and strategy how much to allot per month and which type of debt to priotitize.

Do I need to be good at math or spreadsheets?

No advanced math required. The toolkit comes with pre-built formulas and simple instructions. If you can type numbers into a spreadsheet and follow step-by-step prompts, you’ll be fine.

What happens after I buy the playbook + toolkit?

Right after checkout, you’ll receive an email with your login details. Inside the portal, you’ll see the full playbook, videos, and toolkit. You can start with the welcome lesson and then follow the suggested path.

Can I share my access with my partner or family?

You can absolutely go through the material with a partner or spouse using the same login. We simply ask that you don’t publicly share or resell the files. If multiple family members want to enroll, send us a message for a small group package.

Copyright Millionaire in Progress 2026. All rights reserved